Shoppers face rising dangers as CFPB monetary safeguards crumble

Rob Haskell hoped a brand new rule would defend his credit score report from hundreds of {dollars} in payments for latest coronary heart procedures. As an alternative, he’s bracing for influence from President Donald Trump’s push to slash monetary laws.

“I’ve all the time had medical debt hanging over me however, you recognize, it’s simply utterly unmanageable,” Haskell mentioned in late Could. He was talking to NBC Information from a hospital mattress at PeaceHealth St. Joseph Medical Heart in Bellingham, Washington, days earlier than an open coronary heart surgical procedure that threatened to yield one other steep invoice.

“So, to the moon on that one,” he sighed.

Lots of people don’t essentially know in regards to the CFPB and should not perceive the way it’s being attacked, however they are going to be affected.

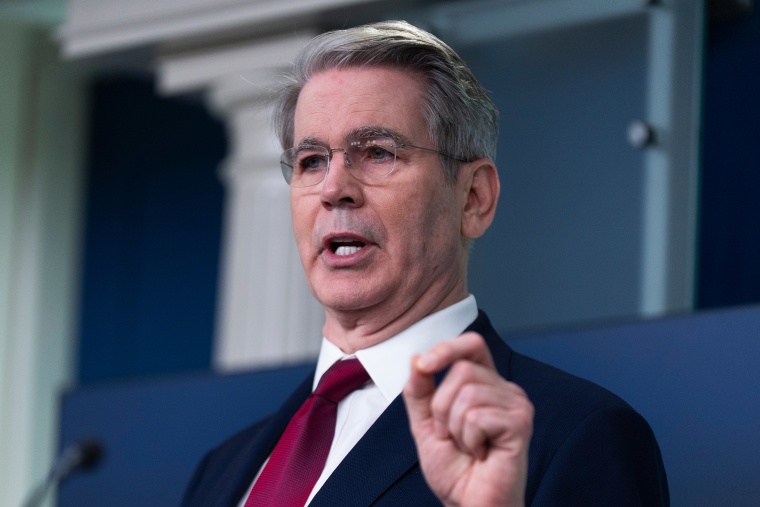

Adam Rust, client federation of america

The 58-year-old contractor mentioned he has battled a collection of coronary heart and kidney points for many of his life. Regardless of having medical health insurance, his medical wants have resulted in hundreds of {dollars} in debt.

Haskell just lately paid off a $5,000 invoice that knocked his credit score rating 21 factors decrease — debt that may have been spared from his report underneath a rule instituted within the remaining days of the Biden-era Shopper Monetary Safety Bureau. The CFPB estimated on the time that the measure would have spared $49 billion in payments from hitting the stories of 15 million folks.

However in April, Trump-appointed management on the client watchdog reversed its place and threw its assist behind credit score unions and client reporting firms looking for to dam the rule in a Texas federal courtroom. After twice delaying the coverage’s March begin date, the choose is predicted to rule inside days.

Haskell used some retirement financial savings to repay his final operation, in 2024. Earlier than his coronary heart surgical procedure final month, he’d hoped the medical debt rule would lastly assist clean out his funds, increase his credit score rating above 700, and enhance his possibilities of shopping for property to construct a house. That now seems unlikely.

“There actually was little or no details about the entire thing,” Haskell mentioned of the CFPB’s about-face. “I used to be actually shocked.”

The change provides to the monetary dangers shoppers more and more face from months of cuts and coverage rollbacks on the company, advocates say, contributing to broader financial uncertainty stoked by Trump’s commerce struggle. Since January, CFPB management has tried to fireside almost the entire company’s 1,700 staff, halted commonplace supervisory and enforcement actions and blocked guidelines aimed toward buttressing shoppers’ wallets.

The actions have surprised client advocates who simply months in the past had anticipated at the very least a number of the Biden-era steering to stay untouched. Some pointed to the populist financial message that propelled Trump again into the Oval Workplace, regardless that the CFPB — itself a byproduct of populist frustrations churned up by the 2008 monetary disaster — has drawn GOP ire since its inception.

“These guidelines usually are very politically widespread,” mentioned Chi Chi Wu, a senior lawyer on the Nationwide Shopper Legislation Heart, a nonprofit group that stepped in to defend each the medical debt rule and a separate one capping overdraft charges at massive banks at $5. The latter measure was voided in early Could when Trump signed Home Republicans’ decision repealing it. When federal businesses’ insurance policies are nullified underneath the Congressional Overview Act, they’re prevented from issuing considerably comparable ones sooner or later.

“They’re actively harming common, hard-working Individuals in order that their billionaire buddies can revenue,” Wu mentioned of administration officers. “There’s actually no different approach to have a look at it.”

Spokespeople for the CFPB and the White Home didn’t reply to requests for remark.

The Trump administration has solid its adjustments as efforts to fight authorities overreach. In remarks to the American Bankers Affiliation in April, Treasury Secretary Scott Bessent, who was appointed performing director of the CFPB in late January, described Biden-era guidelines as politically biased and criticized their “compliance prices” that would impede “accountable lending and risk-taking.”

“The related mission drift can lend itself to political ends,” he mentioned on the time.

The patron banking business has applauded efforts to rein within the company.

“How will we take politics out of regulation, the place it by no means ought to have been?” Lindsey Johnson, president and CEO of the Shopper Bankers Affiliation, mentioned at a latest business occasion. She additionally thanked Trump in an announcement final month cheering the elimination of the overdraft rule “for safeguarding client alternative and entry to a deeply valued monetary instrument utilized by hundreds of thousands of Individuals in instances of want.”

Republican policymakers, each on the CFPB and in Congress, have taken steps to unwind different latest monetary laws.

In April, a Biden-era rule capping most bank card late charges at $8 was eradicated. So was a coverage aimed toward tightening laws across the sale of shoppers’ monetary knowledge and Social Safety numbers. The CFPB has additionally deserted a lawsuit in opposition to the three massive banks that function the digital funds platform Zelle, which was accused of mishandling customers’ fraud complaints totaling greater than $870 million since 2017.

Gone, too, are oversight powers over massive tech firms providing cost instruments and plans to carry Purchase Now, Pay Later providers — which have quickly turn into many shoppers’ default alternative of credit score — to the identical laws as card issuers.

“Lots of people don’t essentially know in regards to the CFPB and should not perceive the way it’s being attacked, however they are going to be affected,” mentioned Adam Rust, director of monetary providers on the Shopper Federation of America. “Partisanship is what’s driving these actions, each by Congress and the CFPB, and it strikes me as an inside-the-Beltway recreation that ignores the impact on common folks.”

Within the meantime, some advocates are shifting focus to state and municipal safeguards. New York Metropolis Comptroller Brad Lander printed a report this week outlining how town and the state can fill the void left by a CFPB “in disaster,” recommending a client restitution fund and financial institution overdraft caps. In January, California instituted its personal prohibitions on well being care suppliers and debt collectors from reporting medical debt to credit score businesses.

Nonetheless, Armen Meyer, a monetary coverage guide who has served as each a fintech govt and a financial institution regulator, mentioned he expects “many, many shoppers will likely be harmed irrespective of how a lot the states arise.”

If you’re broke, you’re broke. You simply do what you possibly can to outlive.

George Curlee, Garland, Texas

George Curlee, 51, is keenly conscious of how the CFPB’s coverage reversals threaten his funds.

In 2023, the Garland, Texas, resident underwent an emergency toe amputation that resulted in $61,000 in complete medical debt regardless of the insurance coverage he’d bought on an Inexpensive Care Act market. Across the similar time, he was fired from his retail job and his credit score rating plunged 60 factors.

Curlee mentioned he has since managed to whittle the debt right down to about $50,000 and located part-time work in March. The job pays lower than half his earlier $40,000 annual wage, and he’s been dwelling with two of his brothers to economize.

“If you’re broke, you’re broke,” he mentioned. “You simply do what you possibly can to outlive.”

Curlee now fears worse to return due to Home Republicans’ so-called Massive Lovely Invoice, which the Congressional Finances Workplace estimates would push at the very least 16 million folks off medical health insurance by 2034 — together with those that pay for ACA protection like him. He has since joined advocates to foyer policymakers in opposition to the proposed cuts and in favor of preserving the medical debt rule.

“I actually want that politicians would take the politics out of those payments and do what’s proper for the American folks,” he mentioned. “It is a little insane.”