Do you qualify for second stimulus verify? Quantity of stimulus verify

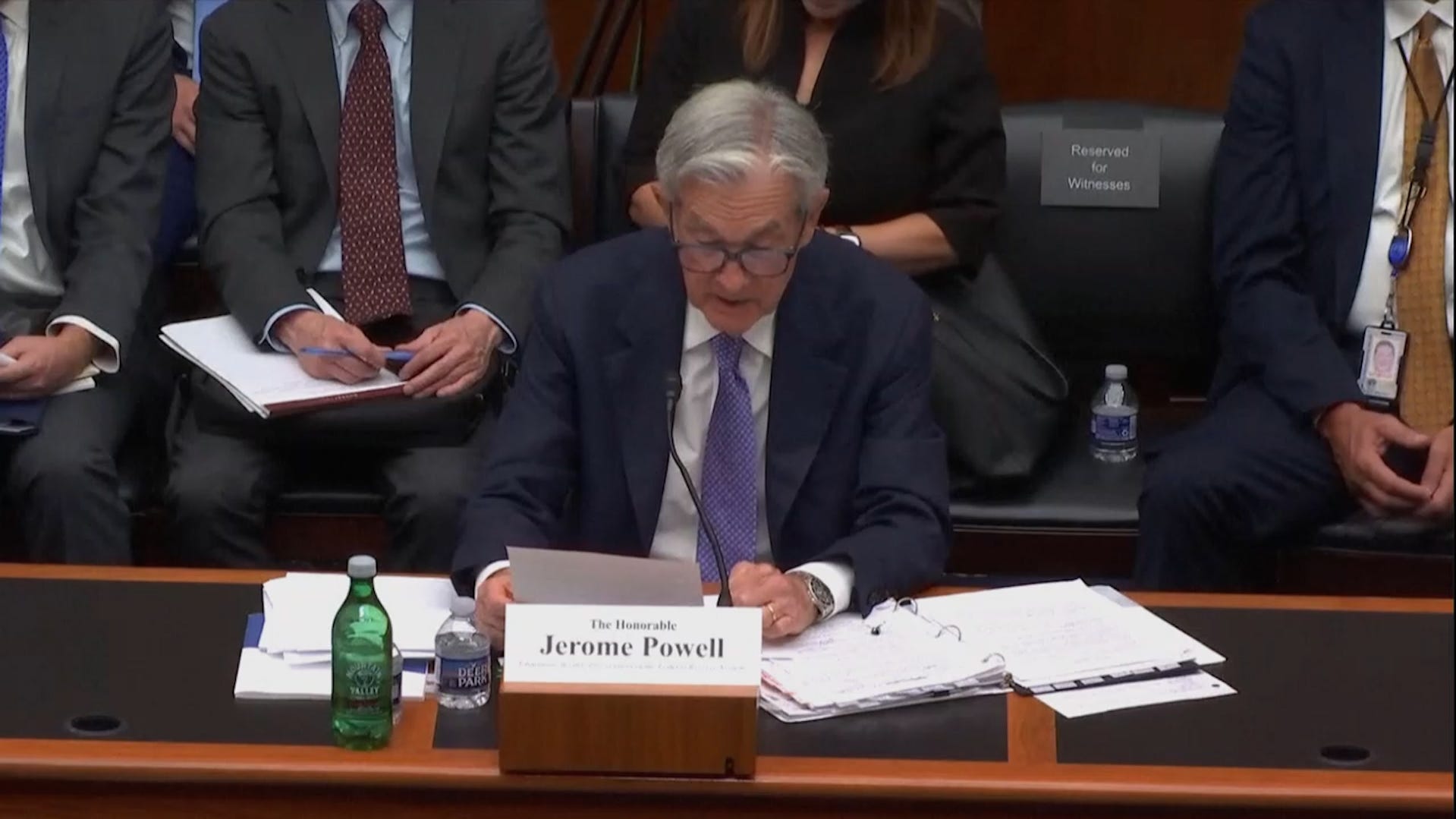

Fed chair Powell says no Trump stress to decreasing rates of interest

President Donald Trump has put stress on the Federal Reserve to decrease rates of interest and Jerome Powell continues to be saying no.

Do you qualify for one more stimulus verify? Some taxpayers are nonetheless ready on the opportunity of a stimulus verify in 2025 from President Donald Trump or a earlier unclaimed stimulus from the Inside Income Service.

This is what to know in regards to the second, third and fourth stimulus checks, quantities and an replace on their standing.

The primary stimulus verify was for as much as $1,200 for people and $2,400 for married {couples}, plus $500 per qualifying youngster underneath the age of 17. Whereas the second verify was as much as $600 per particular person, $1,200 for married {couples} and $600 per qualifying youngster underneath 17.

The third stimulus verify was for $1,400 per eligible particular person and married {couples} submitting collectively obtained a further $1,400 for every qualifying dependent.

The alternatives to assert or file for the primary stimulus fee (issued in March and April 2020) or the second stimulus verify (issued by Jan. 15, 2021) or the third stimulus verify (issued between March and December 2021) have now handed.

The deadline to file for the third and laste stimulus verify was April 15, 2025; it marked a three-year deadline to assert any tax refunds or on this case, the $1,400 Restoration Rebate Credit score for 2021.

It’s best to work instantly with the Inside Income Service (IRS) or a good tax skilled to deal with lacking stimulus funds or declare the related Restoration Rebate Credit score in your tax return, if eligible.

Even in case you obtained a tax extension, you continue to wanted to file your 2021 tax return by the April 15, 2025 deadline to assert that third stimulus verify. There are not any extensions or appeals out there for missed deadlines, and any unclaimed stimulus funds change into the property of the U.S. Treasury.

Whereas hypothesis a couple of fourth stimulus verify of $2,000 has surfaced on social media and unverified web sites, there was no official affirmation from Congress or the IRS to help this declare and any such information must be taken with warning because it might be misinformation or tried fraud.

In February, Trump stated he would take into account the plan to pay out $5,000 stimulus checks to taxpayers within the type of a “DOGE dividend” throughout a summit in Miami. He defined it as utilizing a part of the 20% of the financial savings recognized by Musk’s Division of Authorities Effectivity (DOGE) and giving it again to taxpayers. Nevertheless, he has not shared any additional specifics or particulars in regards to the attainable “DOGE dividend” or its certainty since then.

BBB warns of stimulus verify textual content message rip-off

The IRS is issuing $1,400 tax rebate checks to eligible taxpayers, however scammers are sending faux texts pretending to be the IRS.

Fox – Fox 29

This is what to learn about monitoring your tax refund and when to count on it.

When will I get my tax refund?

Should you filed your federal taxes electronically and included your banking data, then it’s possible you’ll count on a direct deposit inside 21 days. Should you didn’t embrace banking data, then it’s possible you’ll count on a paper verify refund through the mail inside six to eight weeks.

Submitting your return is just not the identical because the IRS accepting your return. As soon as it’s accepted, you’ll comprehend it has in case you see a “Refund Despatched” alert whenever you verify your tax return standing on-line, at which level you will not have to attend too lengthy for the funds to indicate up in your account.

As soon as the IRS approves your refund, it may hit your checking account inside days through the direct deposit choice.

The way to verify on my federal refund standing?

The IRS has a web based instrument referred to as “The place’s My Refund” that means that you can verify on the standing of your refund. Click on right here.

You can begin checking the standing of your refund inside 24 hours after you e-filed your return. The refund data is up to date on the IRS web site as soon as a day, in a single day.

The net instrument requires you to enter your Social Safety quantity, submitting standing and precise refund quantity on the return. It is going to then reply with a return obtained (processing), refund accepted (making ready to subject refund by date proven) or refund despatched (ship to your financial institution or within the mail).

Once more, as soon as it exhibits the IRS has accepted your refund, it may hit your checking account inside days through the direct deposit choice.

The opposite method to verify on the standing is to name the IRS at 800-829-1954.

What’s IRS refund schedule 2025?

In case your taxes have been electronically filed and accepted by April 15, it’s estimated that you could be count on a direct deposit federal refund from the IRS by Might 6 or June sixteenth by mail.

Maria Francis is a Pennsylvania-based journalist with the Mid-Atlantic Join Group.