which crypto dealer is the higher purchase?

Robinhood and Coinbase are two of essentially the most outstanding publicly traded names tied to the cryptocurrency ecosystem. Whereas each have attracted investor curiosity, their present technical setups inform two very totally different tales. On this evaluation, we look at current value motion, key assist and resistance ranges, and structural patterns to find out which asset presents a greater short-term maintain within the present market setting.

The current power in fairness markets has filtered into crypto-linked shares, with each Robinhood (HOOD) and Coinbase (COIN) displaying indicators of motion. Nonetheless, whereas each shares have benefited from broader macro tailwinds and elevated digital asset hypothesis, their technical landscapes differ sharply. One is driving a clear bullish pattern, whereas the opposite stays caught in a large, indecisive vary.

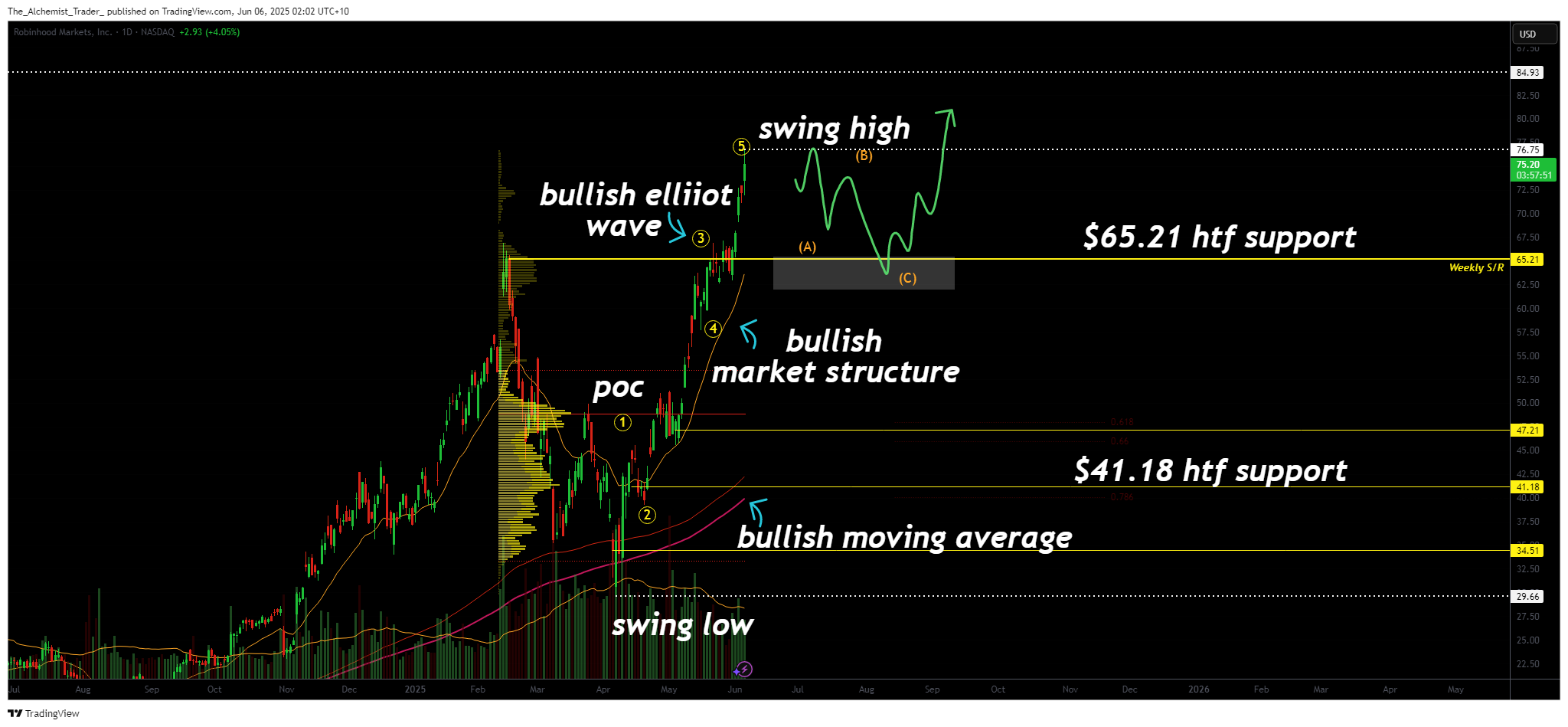

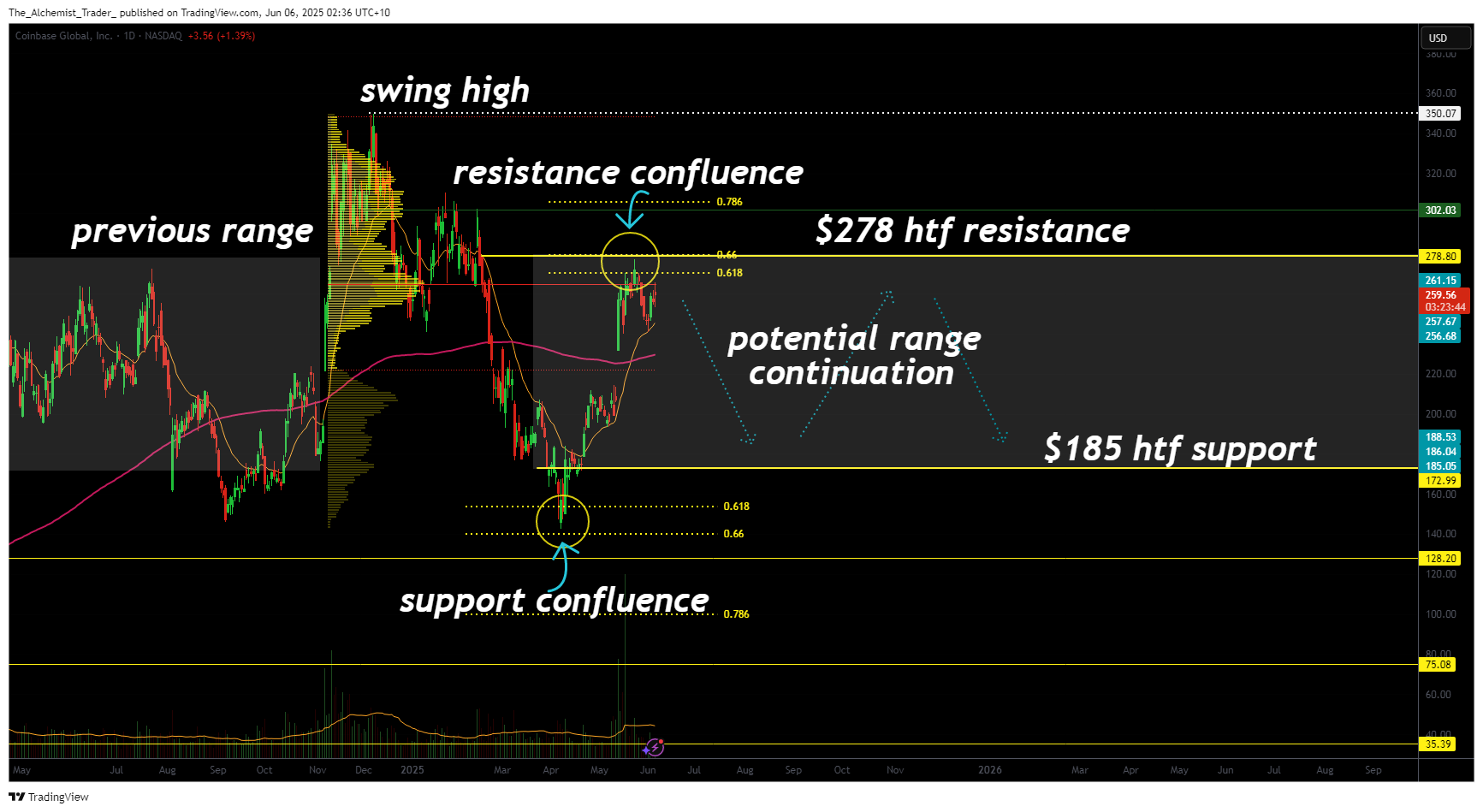

Robinhood has demonstrated robust value motion after forming a key swing low and seems to be transferring inside a textbook Elliott Wave sample. In the meantime, Coinbase has proven way more sluggishness, with value rotating between main assist and resistance zones, typical conduct in a ranging market construction. The distinction between the 2 units the stage for a decisive reply as to which inventory is healthier positioned for short-term positive aspects.

Key technical factors

- Robinhood Elliott Wave Depend in Progress: Robinhood is presently in Wave 5 of a bullish Elliott Wave sample, signaling potential for additional continuation after a quick corrective section.

- Robinhood Key Assist at $65.21: Value wants to carry above this weekly SR stage for continuation larger. This stage will decide whether or not the bullish pattern resumes.

- Coinbase Vary Certain Between $185 and $278: COIN stays trapped in a long-term horizontal channel, with no signal of breakout or sustained momentum past key boundaries.

Value motion on Robinhood exhibits a transparent bullish advance. After forming a swing low at $29, the inventory entered a robust rally that matches the framework of an Elliott Wave sample, one of the crucial frequent bullish continuation formations. The present construction suggests a accomplished or practically accomplished 1-2-3-4-5 depend, inserting value motion inside or close to the terminal stage of Wave 5.

The completion of Wave 5 usually indicators a corrective section, generally an ABC retracement, earlier than continuation. A brief-term pullback is due to this fact not solely attainable however anticipated. On this context, the $65.21 stage, a high-timeframe assist beforehand damaged and reclaimed, is the crucial zone to observe. If this stage holds throughout a pullback, it could present the technical setup for a bullish re-accumulation and continuation larger.

Structurally, Robinhood continues to print larger highs and better lows, affirming bullish momentum. The current transfer to $76 marks a brand new native excessive, a breakout that isn’t being mirrored in Coinbase’s chart.

In distinction, Coinbase stays caught in a large horizontal vary, buying and selling between $185 assist and $278 resistance. This vary has dictated the inventory’s conduct for a number of months, with repeated rejections at resistance and failures to carry breakouts, basic range-bound conduct.

These circumstances normally require a decisive breakout above resistance or a breakdown under assist to determine a brand new pattern. Till then, value is more likely to proceed oscillating between boundaries, providing little readability for medium-term pattern merchants.

Regardless of optimistic macro circumstances and crypto power, COIN has but to point out breakout affirmation. The absence of upper highs or directional quantity reinforces a neutral-to-bearish technical profile within the quick time period.

Placing the 2 charts facet by facet, the distinction in construction turns into instantly evident. Robinhood is in a trending setting, supported by bullish quantity profiles, Elliott Wave construction, and breakout value motion. Coinbase continues to be trapped in a consolidative section, with no confirmed breakout or bullish continuation sign.

Momentum indicators like RSI additionally favor Robinhood, which stays comfortably above its 200-day transferring common. Quantity conduct reinforces this: Robinhood exhibits growth throughout rallies and wholesome consolidation between strikes, indicators absent from Coinbase’s sideways drift.

Moreover, the confluence at Robinhood’s $65 zone provides technical conviction to the bullish case. A profitable retest of this stage would supply a low-risk lengthy setup focusing on a retest of $76 and doubtlessly new highs.

What to anticipate within the coming value motion

Within the instant quick time period, Robinhood seems to be the stronger technical maintain. The bullish Elliott Wave construction, new excessive formation, and key assist under all level to a continuation of the uptrend — assuming a profitable retest of $65.21.

Coinbase, alternatively, continues to be in a buying and selling vary with no technical breakout confirmed. Till value both clears $278 or breaks under $185, the asset is extra more likely to proceed oscillating inside the vary — providing much less upside potential and extra uncertainty for short-term holders.

For traders on the lookout for publicity to a trending crypto-related inventory, Robinhood is presently the better-positioned asset. A profitable pullback and maintain above assist may mark the start of a brand new bullish leg, whereas Coinbase nonetheless must show it might break its excessive timeframe vary.