Cardano worth faces draw back threat amid weak community exercise

Cardano worth has moved into a neighborhood bear market and is prone to additional draw back as community exercise and social dominance wane.

Cardano (ADA) slumped to $0.668 finally verify on Saturday — down by 22% from its highest level in Could. It’s hovering at its lowest level since Could 6.

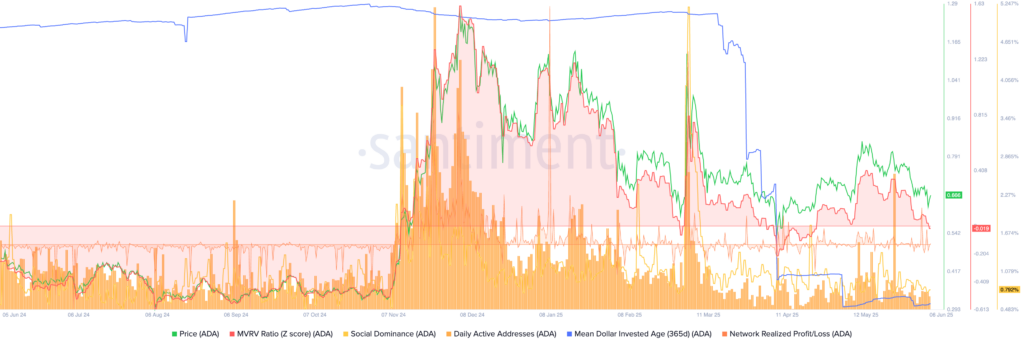

On-chain metrics present that Cardano could also be on the verge of extra draw back. Santiment information exhibits its social dominance rating has moved to 0.792%, down from 1.8% in Could. This metric signifies that fewer persons are discussing Cardano on social media platforms like X and Reddit.

One other metric exhibits that the each day lively addresses have fallen previously few weeks. There have been 21,565 addresses on Friday, down from over 60,500 in Could, an indication that fewer persons are interacting with it.

Additional, the intently watched imply greenback invested age (MDIA) has plunged, an indication that previous cash are being moved. The 365-day MDIA determine has tumbled to minus 425, down from 62 in September final yr.

The community realized revenue/loss has moved adverse to the adverse zone, signaling that patrons have began to capitulate.

Lastly, the Market Worth to Realized Worth or MVRV ratio has turned adverse, signaling that Cardano has develop into a discount. Nevertheless, the MVRV ratio of minus 0.019, is larger than it was in April when the coin bounced again.

Other than on-chain metrics, extra information exhibits that Cardano’s ecosystem just isn’t doing properly.

The entire worth locked in its decentralized finance ecosystem has dropped to $387 million, whereas the whole provide of stablecoins is simply $30 million.

These metrics are a lot decrease than Sonic and Unichain, which launched earlier this yr.

Cardano worth technical evaluation

The each day chart exhibits that the Cardano worth has plunged from $1.317 in December to $0.66 right now. It has moved under the descending trendline that connects the best swings since December.

Most lately, it fashioned a small double-top sample at $0.845, and has moved under its neckline at $0.713, its lowest level on Could 19.

It has additionally moved under the 50-day and 200-day Weighted Shifting Averages. Due to this fact, the coin will doubtless proceed falling as sellers goal the following key help at $0.513, its lowest level in April, down by 23% from the present stage.