Beginner Bitcoin Whales The Ones Taking Income This Rally

On-chain knowledge reveals the Bitcoin short-term holder whales have been taking considerably extra income than the diamond arms on this rally.

New Bitcoin Whales Are Taking part In Notable Revenue-Taking

In a brand new put up on X, CryptoQuant writer Axel Adler Jr. mentioned how profit-taking has just lately seemed from the 2 main Bitcoin whale cohorts: the short-term holder and long-term holder whales. The short-term holders (STHs) and long-term holders (LTHs) are two broad divisions of the BTC community carried out on the idea of holding time, with the cutoff between them being 155 days.

Equally, ‘whales‘ are additionally a classification of the asset’s buyers, however on this case, the criterion is holding steadiness. Extra significantly, whales are outlined as holders with greater than 1,000 BTC. As such, the STH and LTH whales would check with the big-money members of the STH and LTH teams, respectively.

Now, right here is the chart shared by the analyst that reveals the pattern within the whole quantity of revenue realized by these teams in the course of the previous few months:

Seems to be just like the STH whales have proven some giant profit-taking spikes in current weeks | Supply: @JA_Maartun on X

As displayed within the above graph, each of the teams have participated in some extent of profit-taking just lately. Nonetheless, clearly, the brand new whales who received into the market prior to now 5 months have been those making up for almost all of this promoting. This pattern is totally different from the way it was in January, when the revenue realization was extra balanced throughout these cohorts.

Traditionally, the STHs have tended to be reactive to market occasions, whereas the LTHs have proven resilience. So, the whales falling to the temptation of revenue realization within the current rally is probably not too stunning. That mentioned, to date, the profit-selling available in the market hasn’t but reached the identical highs as in January.

The whales signify a broad group that may be divided additional into the regular-sized whales (1,000 to 10,000 BTC) and ‘mega’ whales (10,000+ BTC). In accordance with knowledge from the on-chain analytics agency Glassnode, the 2 teams haven’t been exhibiting constant conduct just lately.

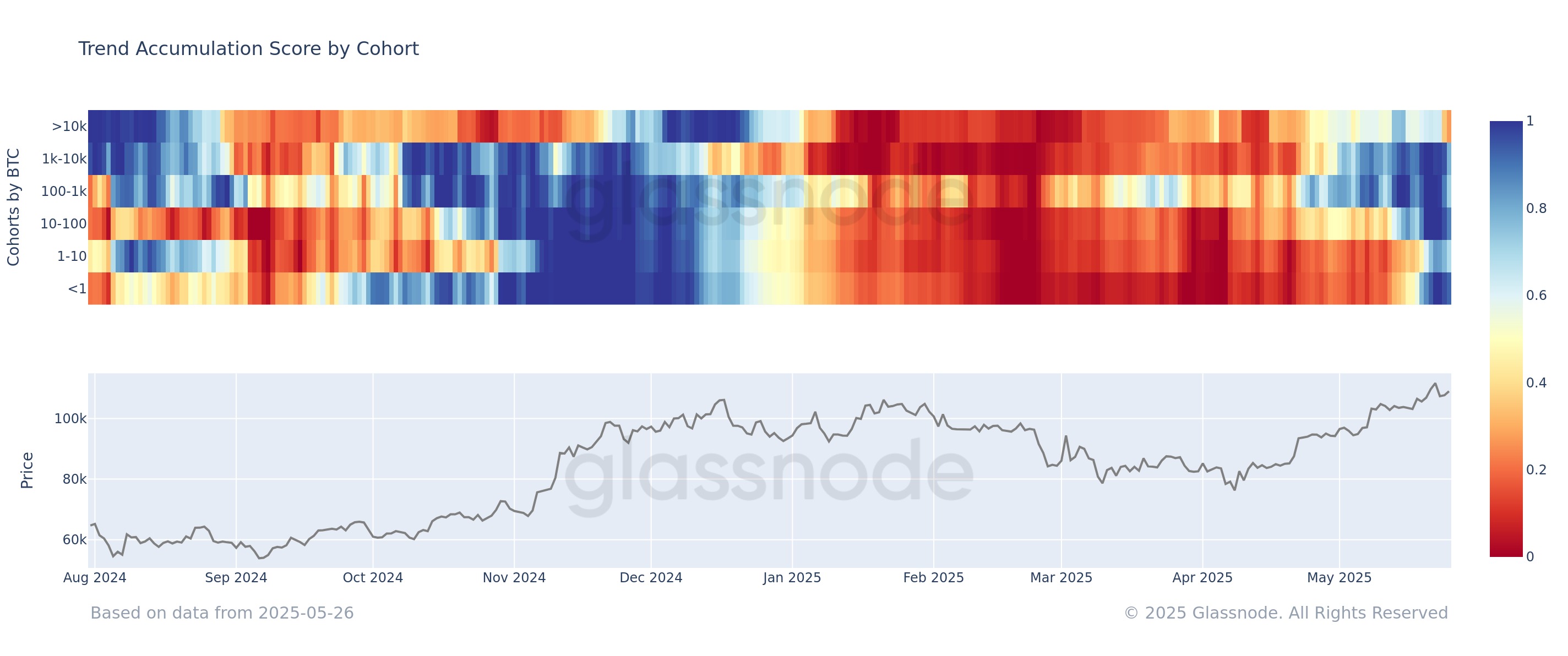

The pattern within the Accumulation Development Rating for the totally different BTC cohorts in the course of the previous 12 months | Supply: Glassnode on X

As is seen within the above chart, the Bitcoin Accumulation Development Rating, an indicator that tells us about whether or not the buyers are accumulating or distributing their cash, has been near 1 for the whales just lately, an indication that these giant entities have been displaying robust accumulation.

The smaller cohorts have additionally been displaying the same conduct, however the mega whales have diverged from the remainder as they’ve taken to distribution as a substitute.

BTC Worth

On the time of writing, Bitcoin is floating round $109,800, up round 6% within the final seven days.

The value of the coin appears to have gone via a pullback because the new all-time excessive | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, CryptoQuant.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.