Billionaire Philippe Laffont Thinks This May Be Price Extra Than Amazon, Meta Platforms, and Tesla By 2030

Philippe Laffont is a billionaire investor and a co-founder of Coatue Administration, a hedge fund that focuses its investments on rising themes throughout know-how, healthcare, and cryptocurrency.

Coatue just lately hosted its annual East Meets West convention, throughout which it revealed a lot of findings which might be fueling capital markets — particularly, the substitute intelligence (AI) revolution.

The place to speculate $1,000 proper now? Our analyst staff simply revealed what they imagine are the 10 finest shares to purchase proper now. Be taught Extra »

Nonetheless, Coatue additionally devoted a portion of its analysis to Bitcoin‘s (CRYPTO: BTC) efficiency during the last a number of years, and the place the cryptocurrency may very well be headed.

In actual fact, Coatue forecasts that Bitcoin might attain a market capitalization of $5.2 trillion by 2030. Not solely does this suggest 153% upside from Bitcoin’s present market worth, but it surely means that it might emerge because the third most precious asset on the earth throughout the subsequent 5 years — trailing solely Microsoft and Nvidia and surpassing the likes of Amazon, Meta Platforms, and Tesla.

Let’s discover what might gas Bitcoin to new highs throughout the subsequent 5 years. Extra importantly, I am going to element a number of alternative ways wherein buyers can put money into the Bitcoin motion.

Bitcoin may very well be on its strategy to changing into a mainstream monetary asset

For a lot of its historical past, Bitcoin has been labeled as a extremely speculative asset — and rightfully so. Between its overly pronounced volatility, rising adoption charges, and ongoing regulatory uncertainties, Bitcoin shouldn’t be precisely as mainstream because the U.S. greenback, for instance.

However, cryptocurrency has progressively turn into extra mainstream throughout the previous a number of years because of a mixture of things.

Retail buyers confirmed early enthusiasm for blockchain know-how and the way outstanding cryptocurrencies resembling Bitcoin or Ethereum may very well be used to facilitate transactions in the actual world.

Over time, massive monetary establishments have additionally turn into extra receptive to the concept of decentralized finance (DeFi) protocols enjoying a task on the earth of funds infrastructure, in addition to the concept that property resembling Bitcoin might act as hedges to inflation — just like the best way gold and sure different different property do.

By way of utility past that of monetary transactions, firms resembling Technique (previously referred to as MicroStrategy) and GameStop have truly acquired Bitcoin to enhance their steadiness sheets. Whereas such strikes have been polarizing from the angle of buyers, holding Bitcoin alongside money and short-term investments shouldn’t be solely not like Palantir‘s technique of holding gold on its steadiness sheet a couple of years in the past.

Picture Supply: Getty Pictures.

Some on Wall Avenue appear to agree with Laffont

Coatue is not the one agency on Wall Avenue predicting a steep rise in Bitcoin over the following a number of years.

Lower than a yr in the past, Tom Lee of Fundstrat World Advisors projected a short-term value goal between $150,000 and $250,000 for Bitcoin. Throughout a current interview on CNBC’s Squawk Field, not solely did Lee double down on his optimistic view, however he asserted that given the restricted provide of Bitcoin obtainable and its perceived worth and evolving use instances relative to different hedges (i.e., gold), its long-term value goal may very well be extra within the $3 million vary — implying a $63 trillion market cap.

Cathie Wooden, head of Ark Make investments, is forecasting a monster upside in Bitcoin as effectively. Her long-term forecast of $1.5 million per coin implies a market cap of $31 trillion — effectively above Coatue’s projection.

Is Bitcoin a very good purchase proper now?

Crucial takeaway from the evaluation explored above shouldn’t be merely that outstanding buyers are calling for big features within the value of Bitcoin. It is understanding the concept that Bitcoin’s mounted provide offers the asset a perceived worth of rarity, and subsequently publicity to the asset may very well be advantageous throughout occasions of financial uncertainty.

To make certain, Bitcoin stays a extremely speculative and unstable merchandise to personal. If direct publicity to Bitcoin is exterior of your threat profile, there are a number of passive methods to put money into the cryptocurrency.

For starters, buyers should purchase spot Bitcoin ETFs such because the iShares Bitcoin Belief or Cathie Wooden’s ARK 21Shares Bitcoin Belief. These funds monitor the worth actions of Bitcoin, however don’t require buyers to purchase the cryptocurrency straight.

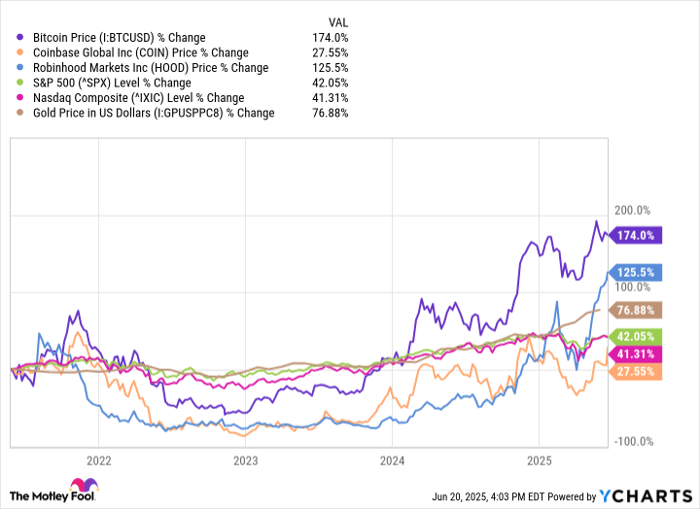

Going one step additional, if buyers wish to maintain property with extra insulated publicity to Bitcoin, they may purchase shares of crypto exchanges resembling Coinbase or buying and selling purposes resembling Robinhood, which has a give attention to crypto.

Bitcoin Worth knowledge by YCharts.

Because the chart above illustrates, Bitcoin and a few of its proxies have outperformed the S&P 500, Nasdaq Composite, and gold during the last yr. Nonetheless, it ought to be famous that the broader market and gold have held up fairly effectively, too.

Given these dynamics, I do suppose some publicity to Bitcoin — be it direct or oblique — may very well be a helpful complementary piece of a diversified portfolio. With that stated, I don’t see Bitcoin or the broader cryptocurrency alternative as superior to conventional funding autos simply but.

Must you make investments $1,000 in Bitcoin proper now?

Before you purchase inventory in Bitcoin, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Bitcoin wasn’t one among them. The ten shares that made the minimize might produce monster returns within the coming years.

Think about when Netflix made this listing on December 17, 2004… if you happen to invested $1,000 on the time of our suggestion, you’d have $664,089!* Or when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $881,731!*

Now, it’s value noting Inventory Advisor’s complete common return is 994% — a market-crushing outperformance in comparison with 172% for the S&P 500. Don’t miss out on the most recent high 10 listing, obtainable whenever you be a part of Inventory Advisor.

See the ten shares »

*Inventory Advisor returns as of June 23, 2025

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Amazon, Meta Platforms, Microsoft, Nvidia, Palantir Applied sciences, and Tesla. The Motley Idiot has positions in and recommends Amazon, Bitcoin, Ethereum, Meta Platforms, Microsoft, Nvidia, Palantir Applied sciences, and Tesla. The Motley Idiot recommends Coinbase World and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.