Canada rescinds Digital Companies Tax after Trump cuts off U.S. commerce talks

Canada has walked again on its digital companies tax “in anticipation” of a mutually helpful complete commerce association with america, Ottawa introduced Sunday evening, simply at some point earlier than the primary tax funds had been due.

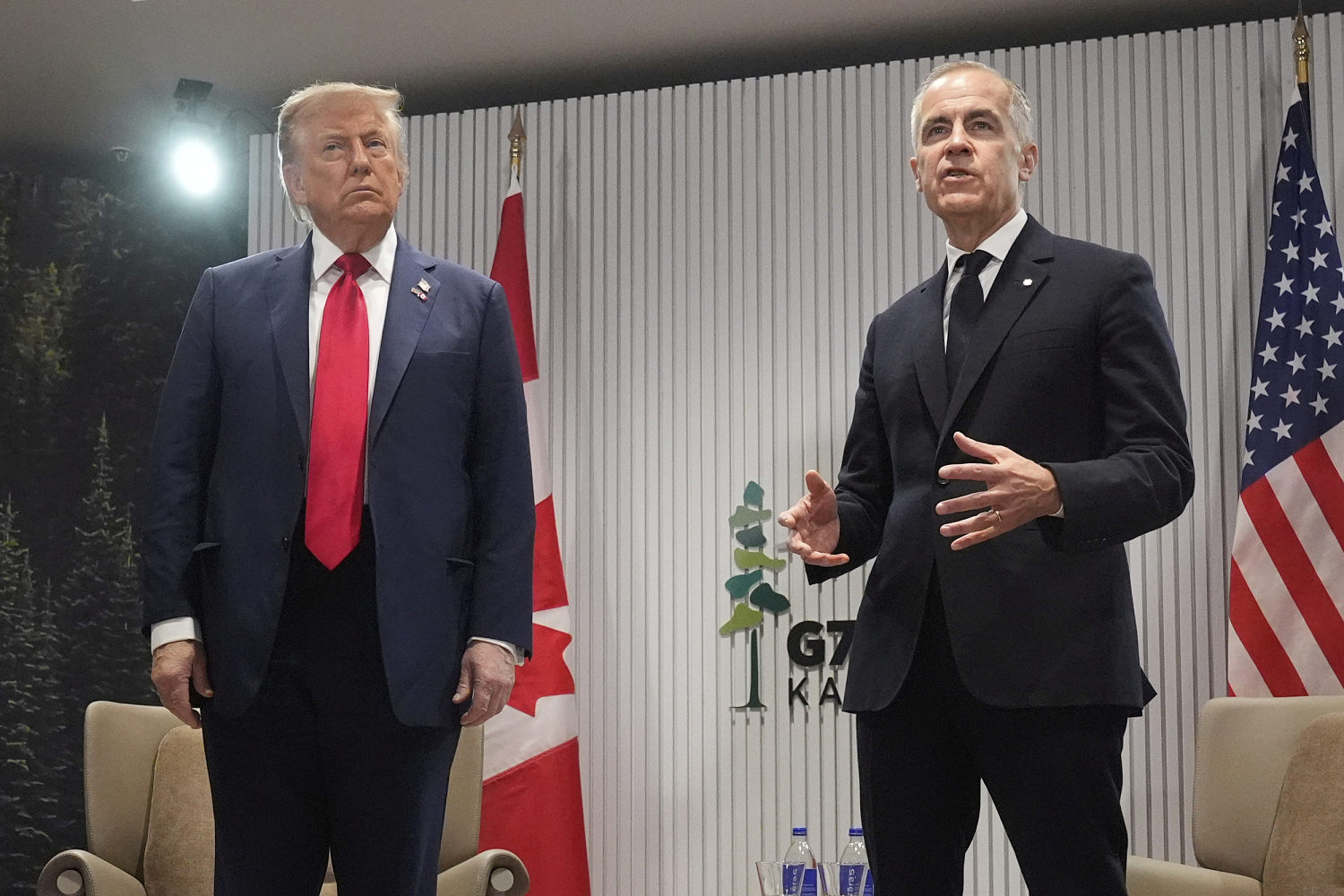

The transfer comes after U.S. President Donald Trump introduced over the weekend that he might be “terminating ALL discussions on Commerce with Canada” in response to Ottawa’s choice to impose a digital companies tax on American tech corporations.

“In the present day’s announcement will assist a resumption of negotiations towards the July 21, 2025, timeline set out at this month’s G7 Leaders’ Summit in Kananaskis,” Canadian Prime Minister Mark Carney mentioned within the assertion.

The primary funds from Canada’s digital companies tax, which was enacted final 12 months and applies retroactively to 2022, had been initially set to be collected Monday. The tax would have utilized to each home and international tech corporations, together with U.S. giants reminiscent of Amazon, Google and Meta with a 3% levy.

This choice from Ottawa was an about-turn from Canadian officers earlier this month, who mentioned they’d not pause the digital companies tax, regardless of robust opposition from the U.S.

Canada’s Minister of Finance and Nationwide Income Francois-Philippe Champagne added, “Rescinding the digital companies tax will permit the negotiations of a brand new financial and safety relationship with america to make very important progress and reinforce our work to create jobs and construct prosperity for all Canadians.”

Nonetheless, the assertion from Canada’s finance ministry additionally mentioned that Carney “has been clear that Canada will take so long as obligatory, however not, to realize that deal.”

The digital companies tax was first launched in 2020 to handle a taxation hole the place many giant tech corporations had been incomes important revenues from Canadians, however weren’t taxed.

Ottawa additionally mentioned that the tax was enacted whereas it labored with worldwide companions — together with the U.S.— on a multilateral settlement that might exchange nationwide digital companies taxes.

Shortly after Trump mentioned that the U.S. was “terminating ALL discussions on Commerce with Canada,” Treasury Secretary Scott Bessent instructed CNBC’s Morgan Brennan that U.S. Commerce Consultant Jamieson Greer could be investigating the tax to “decide the quantity of hurt to the U.S. corporations and the U.S. economic system generally.”

“Canada has this digital companies tax. And several other different international locations do too. We disagree, and we expect that they discriminate in opposition to U.S. corporations,” Bessent mentioned on CNBC’s “Closing Bell: Additional time.”

“A number of international locations throughout the European Union have digital service taxes. None of them have achieved these retroactively,” Bessent added.

U.S. items commerce with Canada totaled roughly $762 billion final 12 months, in accordance with the Workplace of the U.S. Commerce Consultant.