Flipping Uniswap, Flopping on Value: PancakeSwap Paradox

Regardless of a steep drop within the worth of its native token, PancakeSwap is quietly dominating the decentralized change (DEX) panorama.

The Binance-backed platform has leapfrogged rivals like Uniswap (UNI) and Raydium (RAY), processing over $116 billion in month-to-month quantity and racking up hundreds of thousands in charges and income. However even because the DEX sees explosive development in utilization, CAKE — its governance and utility token — has slipped from a late-Could excessive of $2.95 to round $2.30, elevating questions on whether or not market sentiment is out of sync with protocol fundamentals.

This retreat introduced its market valuation to about $745 million.

Nonetheless, DeFi Llama information exhibits that PancakeSwap is now the largest participant within the decentralized change or DEX trade.

The platform dealt with over $4.16 billion value of quantity within the final 24 hours, greater than Uniswap’s $1.6 billion and Raydium’s $529 million. It dealt with $116 billion within the final 30 days, whereas the 2 processed transactions value $95 billion and $27 billion, respectively.

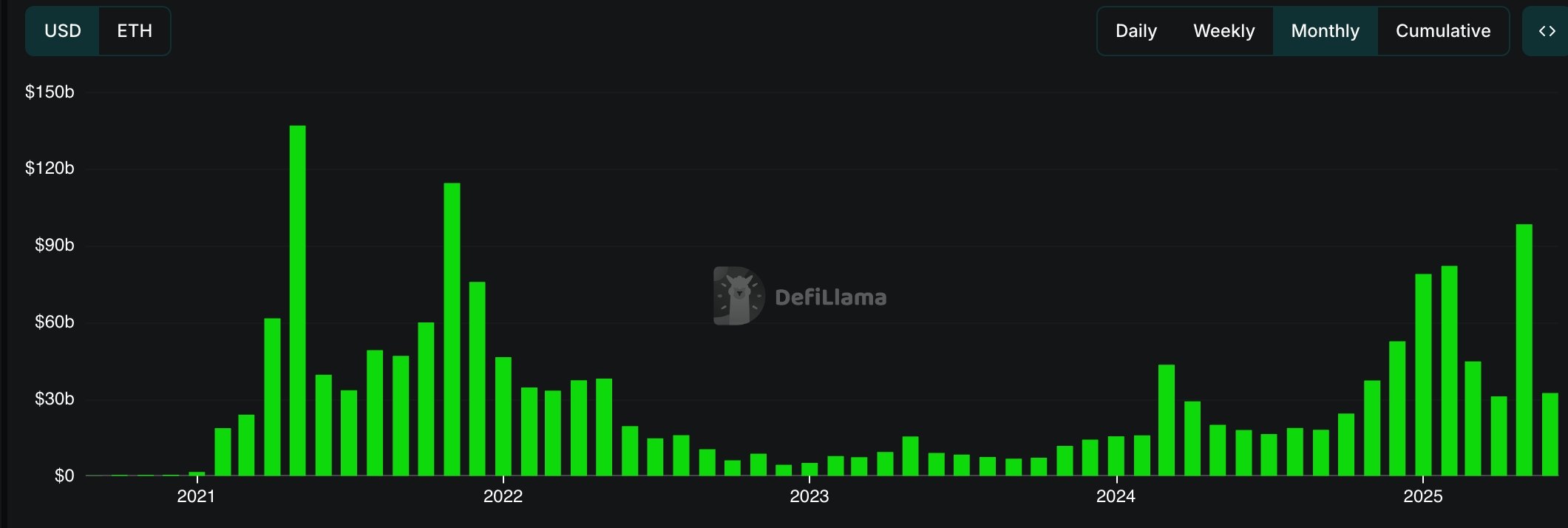

Whereas PancakeSwap has at all times been an enormous participant within the DEX trade, its development surged in Could. Because the chart under exhibits, its month-to-month quantity jumped to over $98 billion in Could from $31 billion a month earlier.

This development led to an enormous improve in charges and income. Its month-to-month charges rose to $131 million in Could from $57 million a month earlier. Its income rose to $32 million from $14 million. Extra metrics on energetic CAKE addresses and staking have additionally jumped.

CAKE worth evaluation

CAKE has remained above the ascending trendline that connects the bottom ranges since Could 11. It additionally stays above the 50-day and 100-day transferring averages.

The chance, nevertheless, is that the token has shaped a small head and shoulders sample. This sample includes a head, left and proper shoulders, and a neckline, the place it’s in the present day.

Due to this fact, a break under these assist ranges will level to extra draw back, with the following level to look at being at $2. That means a 13% drop under the present stage.