‘Right here it Comes,’ Says High Investor About Superior Micro Units Inventory

In some ways, Superior Micro Units (NASDAQ:AMD) has a troublesome job ready within the wings – show to the market that it has what it takes to carve out market share from the industry-dominating Nvidia.

Assured Investing Begins Right here:

The market has been steadily warming as much as AMD, and its share value has gained near 50% since a post-Liberation Day low-point roughly two months in the past. The shifting sentiment is a welcome change for buyers, as AMD had been falling all through the latter a part of 2024 and throughout the first few months of the present 12 months.

This follows a string of excellent information for the agency, together with a powerful Q1 2025 earnings report which contained file revenues of $7.4 billion and gross margins of 54%. A lately introduced $10 billion partnership with a the Saudi Arabian HUMAIN didn’t precisely damage issues both.

One prime investor identified by the pseudonym Stone Fox Capital thinks that the approaching years might carry extra excellent news – particularly because the AI revolution progresses from coaching to inference.

“The AI inference market is about for explosive 80% CAGR development, creating huge upside for a $500 billion AI accelerator market by 2028,” explains the 5-star investor, who’s among the many prime 4% of TipRanks’ inventory execs.

Stone Fox additional particulars that AMD finds itself in a promising place to experience this rising market to wholesome good points. As an example, the investor notes that if AMD manages to seize simply 10% to twenty% of the AI accelerator market, its information heart revenues might vary between $50 to $100 billion by 2028.

“The important thing to the AMD funding story is that the corporate really enters mid-2025 with restricted information heart gross sales compared to the chance forward,” provides Stone Fox.

The investor emphasizes that AMD’s MI355x is coming on-line at simply the suitable second, because it presents an enormous step ahead from the MI300x. Stone Fox even notes that the corporate has steered that the MI355x will have the ability to generate as much as 40% extra tokens per greenback than Nvidia’s B200 GPU.

In different phrases, issues could possibly be taking off for AMD.

“AMD has a chance to grow to be a monster within the AI inference market after lagging within the AI coaching section,” concludes Stone Fox, who’s score AMD a Robust Purchase. (To observe Stone Fox Capital’s observe file, click on right here)

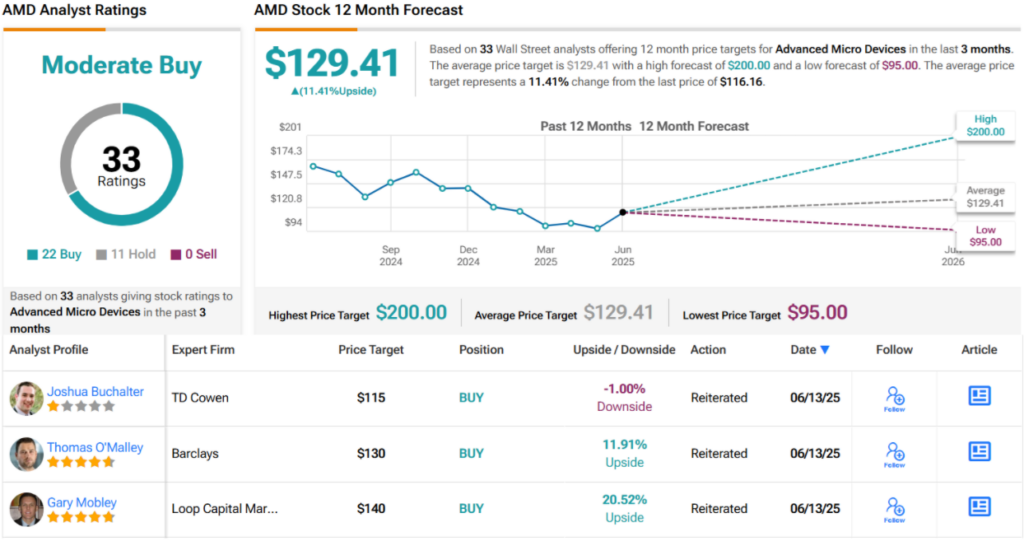

Wall Avenue can also be feeling constructive about AMD’s prospects. With 22 Purchase and 11 Maintain rankings, AMD enjoys a Reasonable Purchase consensus score. Its 12-month common value goal of $129.41 has an upside of ~11%. (See AMD inventory forecast)

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured investor. The content material is meant for use for informational functions solely. It is rather vital to do your personal evaluation earlier than making any funding.

Disclaimer & Disclosure

On the lookout for a buying and selling platform? Take a look at TipRanks’

Greatest On-line Brokers

information, and discover the perfect dealer in your trades.

Report an Concern