The Greatest Mint Options for Monitoring Your Cash

This publish might include affiliate hyperlinks and Corporette® might earn commissions for purchases made by hyperlinks on this publish. As an Amazon Affiliate, I earn from qualifying purchases.

The tremendous widespread private finance device Mint closed up store in 2024 (RIP), and sadly I have never discovered an app that I like as a lot (granted, I have never devoted THAT a lot time to researching instruments, however nonetheless!). For these of you with the identical dilemma, at this time we’re rounding up one of the best Mint options.

If you happen to as soon as used Mint, what have you ever changed it with? How does it evaluate?

And should you bear in mind, sure, couple of months in the past we rounded up 5 nice instruments for managing your finances (together with some useful books!), however at this time we’re going right into a bit extra element relating to apps, as a result of on-line private finance instruments deserve their very own publish! (And the apps under aren’t only for budgeting functions, anyway.)

{associated: how a lot do you retain in your checking account?}

The Greatest Mint Options for Monitoring Your Cash

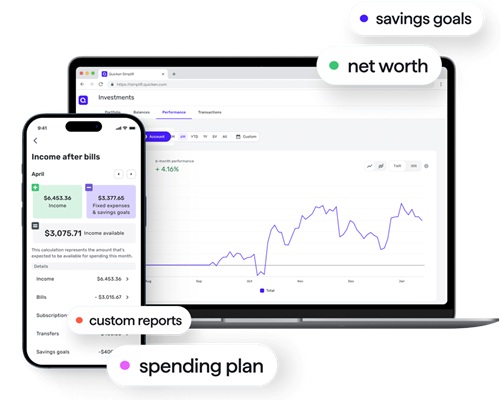

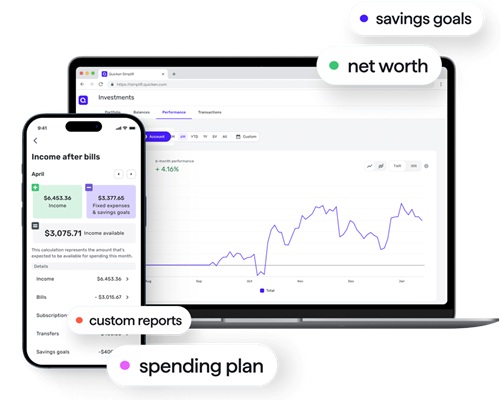

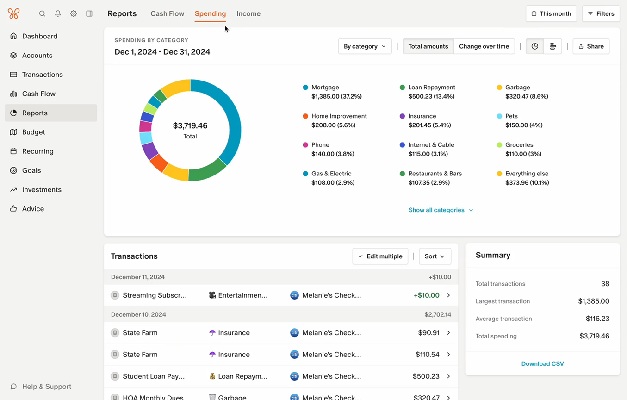

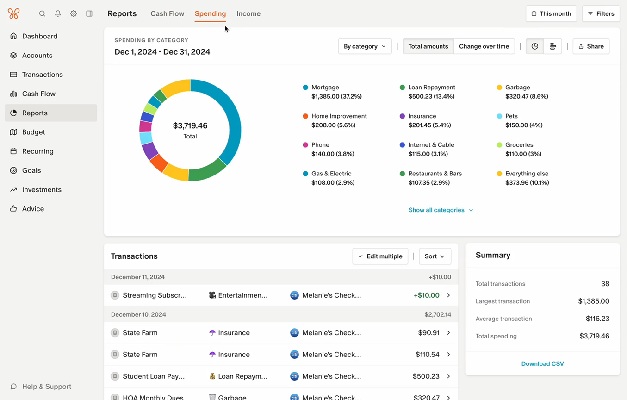

Quicken Simplifi

Along with its primary performance, Quicken Simplifi permits you to create a spending plan for the month, set customized financial savings objectives (with digital financial savings accounts to trace them), join funding accounts, and make a watchlist to watch your spending in keeping with a specific payee, class, or tag. They’ve additionally lately added a retirement function that permits you to take a look at varied eventualities to see how they’d have an effect on your future financial savings.

That can assist you keep on high of your payments, you may obtain electronic mail notifications when you’ve a invoice arising, or when one has been paid — however you possibly can flip these notifications off should you do not want them.

For some gamification, you too can earn badges for actions like connecting an account, avoiding overspending, paying payments on time, and reaching objectives. There’s additionally a web-based neighborhood accessible.

Simplifi usually prices $5.99/month, however the summer season sale provides you a price of $2.99 (billed yearly).

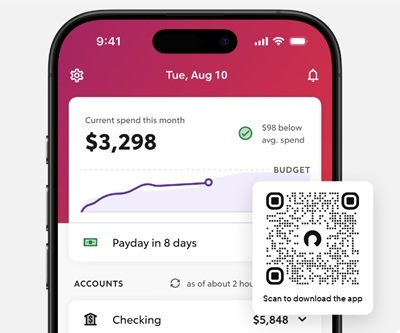

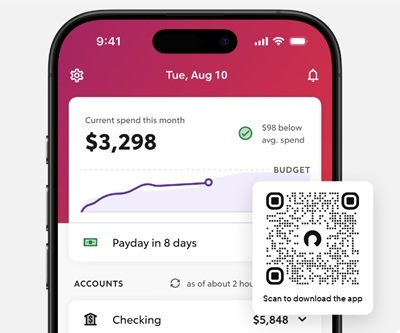

Rocket Cash

Here is how we summarized Rocket Cash within the publish I discussed above:

I have been listening to good issues about Rocket Cash recently (and no, not solely from their podcast advertisements!) It has a few options YNAB would not have, particularly relating to payments and the unneeded subscription companies many people have. (I imply, am I actually studying sufficient Scientific American to holding paying my on-line subscription? I’m not.)

Rocket Cash lists your subscriptions in a single place, and your “concierge” may even cancel them for you (good!). It additionally allows you to monitor your spending and internet price and to maintain tabs on and decrease your payments, with the goal of saving extra and spending much less. It additionally guides your saving habits to succeed in your objectives, has useful cellphone widgets, provides you a free credit score rating, and even negotiates payments for you (for a payment, in fact). Its web site has free private finance guides for members and non-members, and the corporate additionally presents a bank card.)

Whereas Rocket Cash is free, a premium membership with further options is offered for $6-$12/month, and you may join a free 7-day trial (not almost so long as YNAB’s!)

{associated: 3 nice on-line private finance courses}

Monarch Cash

Monarch Cash‘s budgeting, monitoring, and planning capabilities provide plenty of useful options. For one, a cool side of this app is that it has options geared toward {couples}, for these customers who need to monitor collectively. For instance, one person can flag a transaction for another person to overview.

Along with the fundamentals, Monarch Cash permits you to hook up with limitless accounts and has integrations for exterior instruments like like Coinbase, Zillow Zestimates, car values, and Apple Card. The app tracks your subscriptions and presents two finances methods, objective monitoring, customized stories, AI categorizing of your transactions (which you’ll be able to appropriate if wanted, and extra. It additionally has a function referred to as Flex Budgeting for, nicely, added flexibility.

Monarch Cash claims that it join with extra monetary establishments than every other app, however you too can add issues manually to trace them.

The complete costs for Monarch Cash are $8.33/month ($99.99 billed yearly) and $14.99 for a month-to-month subscription, however proper now you may get 30% off your first 12 months. And should you enroll however aren’t a fan, the corporate has a “no-questions-asked money-back assure.”

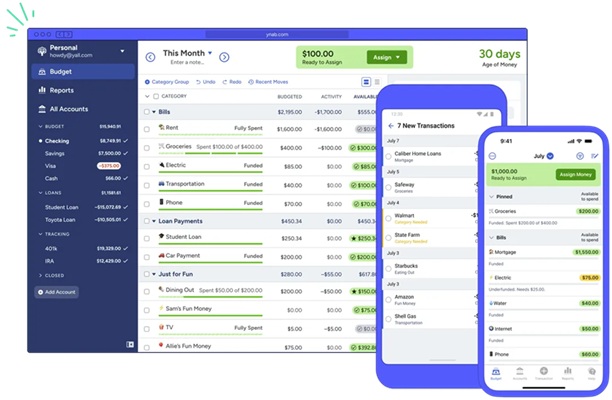

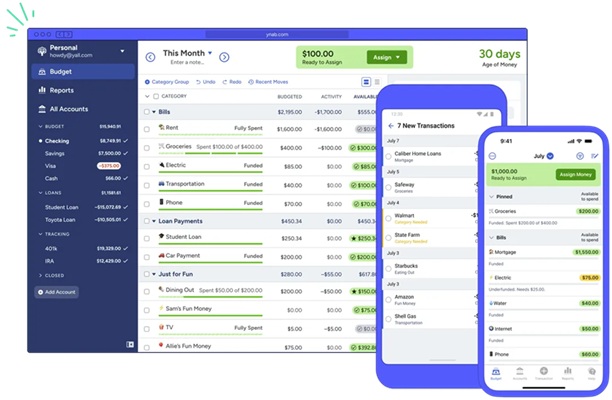

You Want a Price range

Here is what we lately shared about longtime reader-favorite YNAB:

YNAB is a vastly widespread private finance monitoring device, and plenty of readers are huge followers. Its web site guarantees to show customers to “give each greenback a job,” “fund your wildest desires,” “outline priorities and information spending choices towards the life you need,” and “life spendfully.” (Does the phrase “spendfully” trouble anybody else? Eh, I will not maintain it towards the app.)

Along with the fundamental options you’d anticipate, listed here are a couple of others to learn about: all-device syncing, neighborhood challenges, objective monitoring, key stories, debt administration assist, and the power to share your subscription with others. On-line, YNAB additionally presents free Q&As, workshops, a weblog, and a web-based neighborhood.

YNAB has a free 34-day trial (the positioning would not ask on your bank card first), and after that, the charges are $109/12 months (comes out to $9.08/month) or a $14.99/month plan. Here is a information to beginning out with the app.

NerdWallet

As a part of their diversified private finance assets, NerdWallet supplies a free private finance app and companions with monetary firm Atomic Make investments to incorporate further options for customers. This app is greatest for private finance inexperienced persons who do not want a ton of bells and whistles.

First off, the investing instruments: You will get a Treasury account by Atomic Make investments and earn 4.18% APY, and Atomic Make investments additionally presents an Automated Investing account.

And — not shocking from a website like NerdWallet, their app accommodates monetary training subjects in addition to employees scores and critiques for bank cards, checking account, and loans.

Sadly, that is about all the main points the corporate lists on its web site, however once more, it is a comparatively primary, free device.

{associated: cash problem: overview your renewing subscriptions}

Readers, please share your favourite Mint options for monitoring your cash! Have you ever tried a couple of?