This is How Bitcoin’s Value Will get to $1 Million (Adam Again)

As soon as, the thought of the worth of Bitcoin (BTC) hitting $1 million gave the impression of moon-talk, however this notion appears to be altering from fringe hypothesis right into a mainstream funding thesis, championed by a few of crypto’s most influential figures.

Fueled by rising institutional adoption and daring long-term forecasts, the pathway to this worth goal hinges on a seemingly easy, but monumental, shift: Wall Avenue allocating a big slice of its huge wealth to the primary digital asset.

Wall Avenue is the Sport-Changer

On the current Bitcoin 2025 occasion, Technique Government Chairman Michael Saylor emphatically acknowledged:

“When Wall Avenue is 10% Bitcoin, Bitcoin shall be $1,000,000 a coin.”

In keeping with him, this stage of allocation would equate to as a lot as $20 trillion flowing into BTC markets, making a hostile takeover economically inconceivable as aggressive shopping for would solely empower present holders.

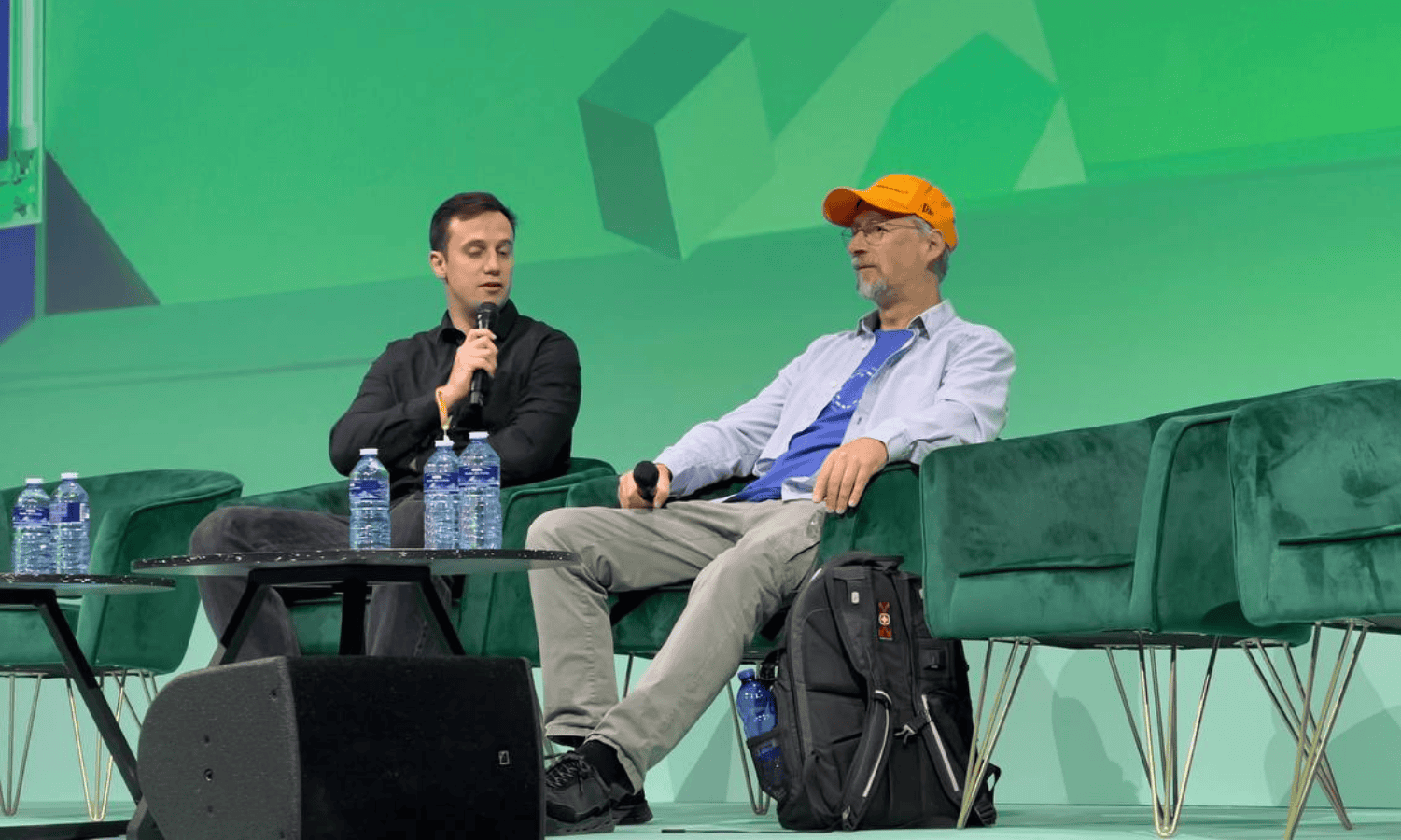

The Bitcoin maxi isn’t alone in his mega-bullish outlook. Blockstream CEO Adam Again believes BTC may obtain the $1 million goal method earlier than Wall Avenue accumulates 10% of the cryptocurrency. He prompt that even a widespread 2% allocation throughout main asset managers like BlackRock can be sufficient to push Bitcoin’s worth to that stage.

It isn’t the primary time Saylor has predicted BTC’s worth hitting seven figures. In a September 2024 interview with CNBC, he forecasted a long-term worth for the king cryptocurrency of $13 million, calling it “excellent cash” in distinction to fiat currencies, which he labeled “pseudoscience.”

Different outstanding voices similar to former Binance chief Changpeng Zhao, popularly often known as CZ, have echoed related sentiment. The crypto entrepreneur beforehand projected BTC may find yourself anyplace between $500,000 and $2 million on this cycle.

Cathie Wooden’s ARK Make investments is one other entity sharing the optimism. In April, the agency revised its base case goal for BTC to $1.2 million by 2030, with a bullish estimate of $2.4 million. ARK attributed the potential surge to institutional adoption, particularly through spot exchange-traded funds (ETFs), in addition to Bitcoin’s rising function as a decentralized, programmable retailer of worth.

Within the firm’s estimation, all bets can be off if BTC manages to seize a minimum of 6.5% of the projected $200 trillion world investable belongings market. This could dwarf gold’s present share at roughly 3.6%, a comparability backed by information that Bitcoin fanatic and early stage angel investor Fred Krueger not too long ago shared, exhibiting that extra People now personal Bitcoin (49.6 million) than gold (36.7 million), with considerably increased common holdings.

Value Efficiency

In the meantime, BTC’s worth motion displays a market digesting its current surge to a brand new all-time excessive of $111,814. On the time of this writing, the asset was buying and selling at $105,466, after oscillating between $105,112 and $106,365 within the final 24 hours.

On the weekly timeframe, it gained a modest 0.6% to outperform the broader crypto market, which dipped 0.8% in that interval. Zooming out some extra, BTC’s present worth is a 2.1% enchancment over the past month, whereas on a yearly foundation, it has soared 52.2%, highlighting a long-term uptrend with temporary pullbacks.

Binance Free $600 (CryptoPotato Unique): Use this hyperlink to register a brand new account and obtain $600 unique welcome provide on Binance (full particulars).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this hyperlink to register and open a $500 FREE place on any coin!